📉 Interest Rates Cut Again: What It Means for You

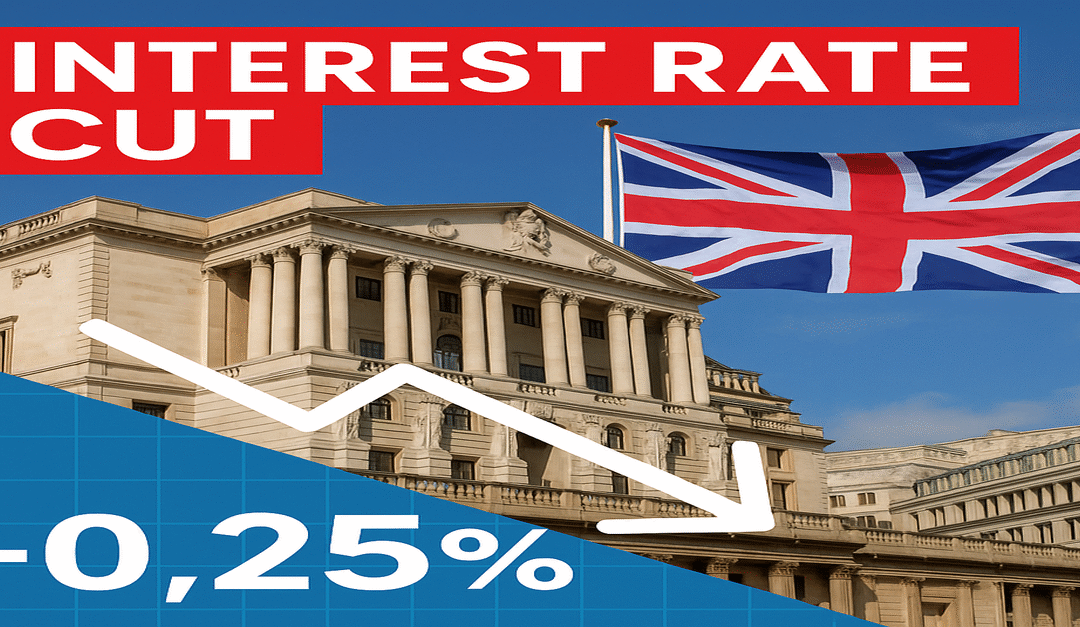

The Bank of England has reduced interest rates by 0.25%, bringing the base rate down to 4.25%—the fourth cut in the past year. This move comes as global economic uncertainty continues, influenced by weaker growth in Western economies and ongoing trade tensions sparked by U.S. tariff policies.

Since August, the Bank’s Monetary Policy Committee (MPC) has been easing rates in response to economic headwinds. While this latest cut was expected, the MPC vote showed a rare split: five members supported the reduction, two wanted a steeper cut, and two voted for no change.

Interestingly, this cut comes despite inflation remaining above the Bank’s 2% target, and forecast to rise further this year. The MPC explained that while inflation is a concern, their priority is to support economic stability. They described their approach as “gradual and careful,” not tied to any fixed path.

What to Expect Next?

Economists anticipate further reductions, with rates potentially dipping to 3.75% by the end of 2025.

Meanwhile, a new UK-U.S. trade agreement is expected soon, following closely on the heels of the UK-India deal. While the economic impact will unfold over time, these developments could boost market confidence.

The Bank’s statement also noted the effects of global trade uncertainty on financial markets but suggested the direct impact on UK inflation and growth should be relatively modest.

Note: The Bank’s announcement was delayed slightly to honour the VE Day silence at 12:00pm.

🔍 What does this mean for you?

Lower interest rates could affect mortgage rates, borrowing costs, and investment returns.

Shifts in interest rates can also have wide-reaching effects—on everything from international payments to business finance and currency strategy. At Frank Exchange Limited, we’re here to help you navigate these changes with clarity and confidence.

Whether you’re managing overseas transactions, planning a major currency exchange, or looking to protect your business from market volatility, our team is ready to support you with expert guidance and tailored solutions.

Get in Touch!

To discuss how the latest rate changes could impact your plans—and how Frank Exchange Limited can help you stay one step ahead.

P: 07441 910 897

E: [email protected]

This document has been prepared solely for information and is not intended as an Inducement concerning the purchase or sale of any financial instrument. By its nature market analysis represents the personal view of the author and no warranty can be, or is, offered as to the accuracy of any such analysis, or that predictions provided in any such analysis will prove to be correct. Should you rely on any analysis, information, or report provided as part of the Service it does so entirely at its own risk, and Frank eXchange Limited accepts no responsibility or liability for any loss or damage you may suffer as a result. Information and opinions have been obtained from sources believed to be reliable, but no representation is made as to their accuracy. No copy of this document can be taken without prior written permission.