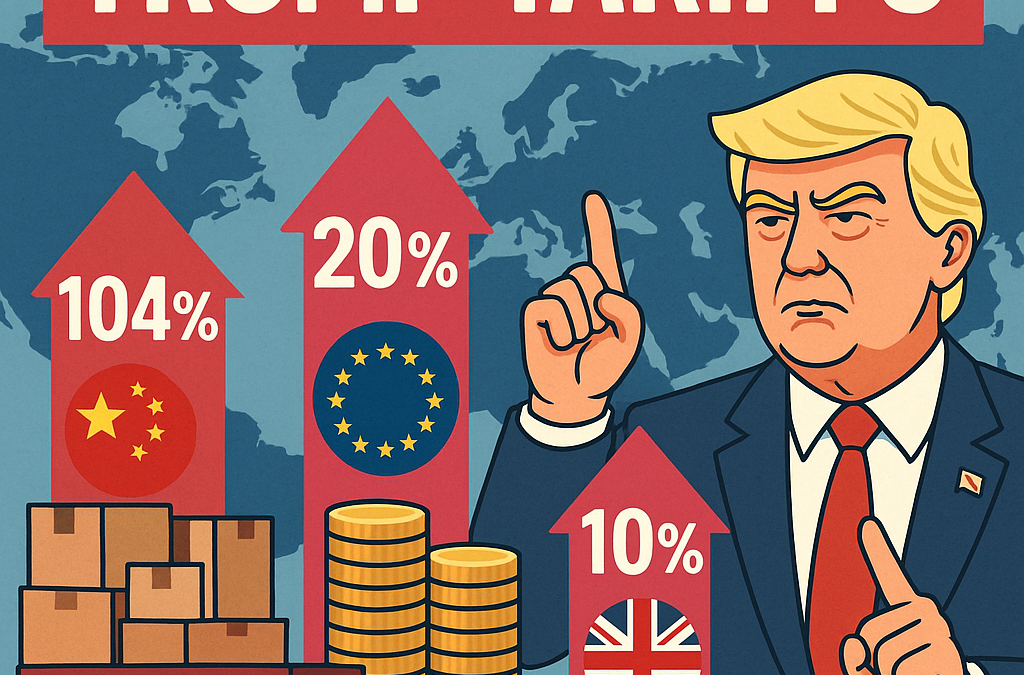

TRUMPS TARRIFS

The global trade landscape is once again under strain, with former President Donald Trump signalling a return to aggressive tariff policies. These measures, aimed primarily at China and the European Union, are reshaping international commerce and raising important questions for businesses reliant on global supply chains and foreign exchange markets.

🔍 Trump Tariffs: Key Highlights

As of April 9th...

📅 Effective from 9th April, a new wave of tariffs has landed—redefining the currency landscape across major economies:

- China: Now facing a staggering 104% tariff on key exports to the U.S.

- Result: CNY (Chinese Yuan) and China proxies (like AUD, KRW, and SGD) have dropped sharply as capital flows out of Asia.

- European Union: Facing 20% tariffs

- Reaction: The EUR has strengthened, being viewed as a de facto safe-haven and a liquid alternative to the USD amid global uncertainty.

- United Kingdom: Targeted with a 10% tariff

- Outlook: Should be GBP positive, as markets see the UK’s diversified trade base and independent monetary policy as supportive.

- Mexico & Canada: Avoided new tariffs for now

- Market impact: MXN and CAD have held firm and are trading positively on relief and risk-on sentiment.

These moves underscore just how quickly trade policy can translate into FX volatility

How Do Tariffs Impact the Market?

Tariffs act as a form of taxation that increases the cost of imported goods.

This leads to:

-

Higher consumer prices

-

Disrupted supply chains

-

Reduced corporate margins

-

Volatile financial markets

For currencies and foreign exchange markets, this means increased risk and uncertainty. Trade wars generally dampen investor confidence, cause capital to flee emerging markets, and can shift currency values dramatically as global flows adjust.

What Comes Next?

FX direction in the coming months will depend heavily on how key nations respond.

- Will countries lay low and negotiate?

- Or will they retaliate further?

While most governments appear open to talks and potential concessions, Trump’s rhetoric hints that only minor tariff reversals are likely— leaving the broader damage to confidence and trade relations largely intact.

However, the mere possibility of negotiation could soothe risk sentiment and offer temporary support to global assets and the U.S. dollar.

Why This Matters to Frank Exchange Clients

With trade tensions rising and supply chains increasingly de-dollarising, your business needs a flexible and robust currency strategy more than ever.

At Frank Exchange, we’ve partnered with The Currency Cloud, powered by VISA, to give your business the global reach it needs:

🌍 Access 40+ currencies across 210+ countries—pay or collect with ease, wherever your business takes you.

🔒 Protect Your Margins: Our forward contracts let you lock in rates today, shielding your profits from tomorrow’s volatility.

💡 Turn Disruption into Strategy: Whether you’re facing shifting tariffs or unstable FX rates, our trusted products and services are built to support you through uncertainty.

In Summary

We are not at the end of the trade war—we’re merely at the end of the beginning. As the world watches how the next chapter of this standoff unfolds, one thing is clear: volatility is the new normal.

But with the right partner, your business doesn’t just have to weather the storm—you can navigate it strategically.

Let Frank Exchange help you make every move count.

Informative post!

Very useful information here- thank you.

Great blog-thank you.

Good info!

Awesome post

Very good information

Very good